Medical Income Limits 2025 Calculator - Affordable Health Care Limits 2025 Devin Feodora, 15 rows to see if you qualify based on income, look at the chart below. Find out if you may qualify. For 2025, if your income is greater than $103,000 and less than $397,000 the irmaa amount is $384.30.

Affordable Health Care Limits 2025 Devin Feodora, 15 rows to see if you qualify based on income, look at the chart below. Find out if you may qualify.

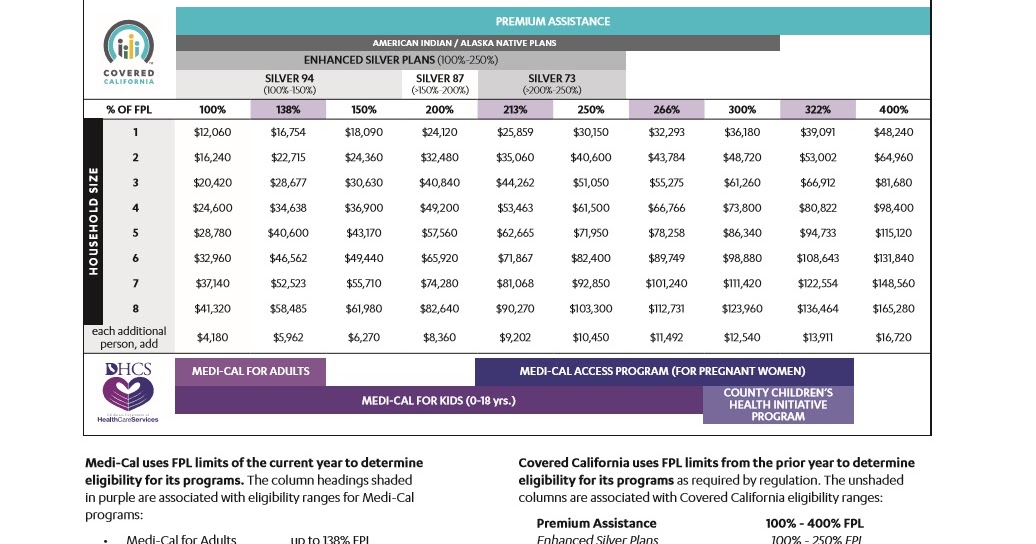

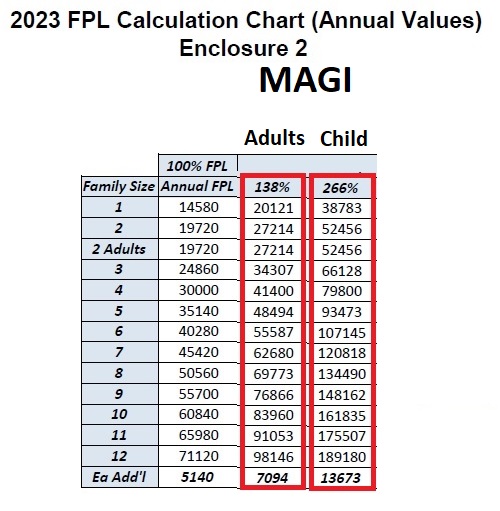

limits for MediCal and CoveredCa in California, Income numbers are based on your annual or yearly earnings. How do i know what to enter for my income?

Revised Covered California 2025 Table, According to the irs, the required contribution percentage is 8.39%, down from 9.12% for 2025 and 9.61% for 2022. Learn about eligibility requirements, how to calculate benefits, and more.

Federal Poverty Level Health Insurances Cost Standards, For 2025, if your income is greater than $103,000 and less than $397,000 the irmaa amount is $384.30. The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

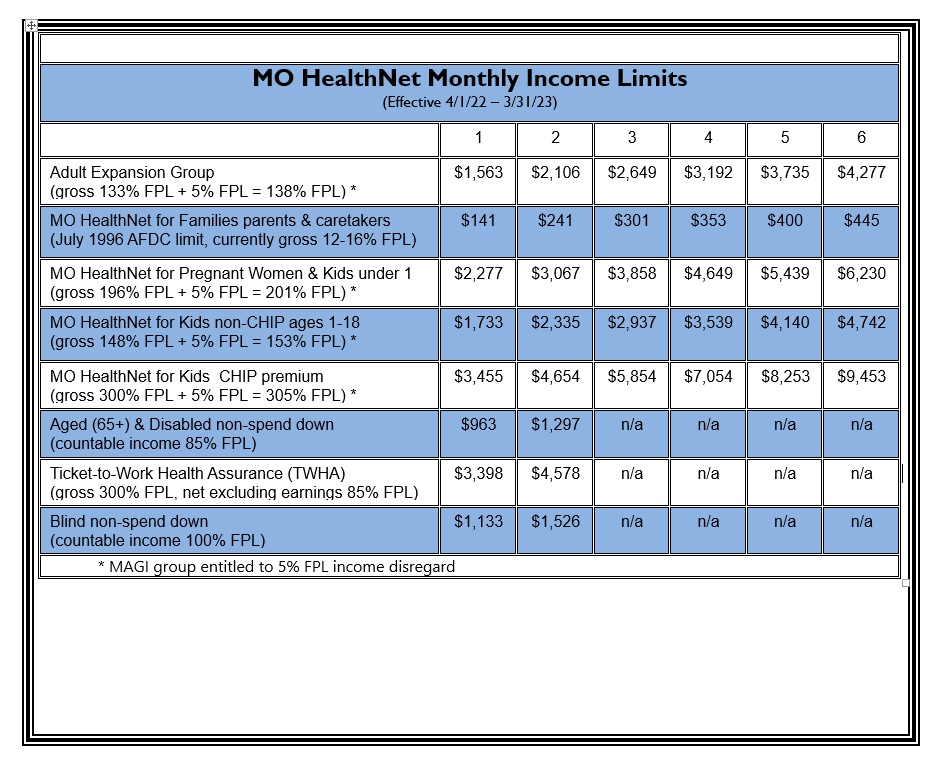

Applying for MO (Medicaid) dmh.mo.gov, Understanding your adjusted gross income (agi) and modified adjusted gross income (magi) is key to predicting your medicare premiums for. Income numbers are based on your annual or yearly earnings.

Medical Income Limits 2025 Calculator. The health insurance marketplace calculator allows you to enter household income in terms of 2025 dollars or as a percent of the federal poverty level. According to the irs, the required contribution percentage is 8.39%, down from 9.12% for 2025 and 9.61% for 2022.

For example, if an application is submitted in march 2025, one could potentially be retroactively eligible for february 2025, january 2025, and december.

According to the irs, the required contribution percentage is 8.39%, down from 9.12% for 2025 and 9.61% for 2022. Single yearly income in 2022:

California MediCal Limits (2025) California MediCal Help, The income range is $30,000 to $120,000 in 2025 for a family of four. For 2025 health insurance plans, you'll use your estimated 2025 income and compare that to the 2025 federal poverty level amounts.

If income is greater than or equal to $397,000 the irmaa.

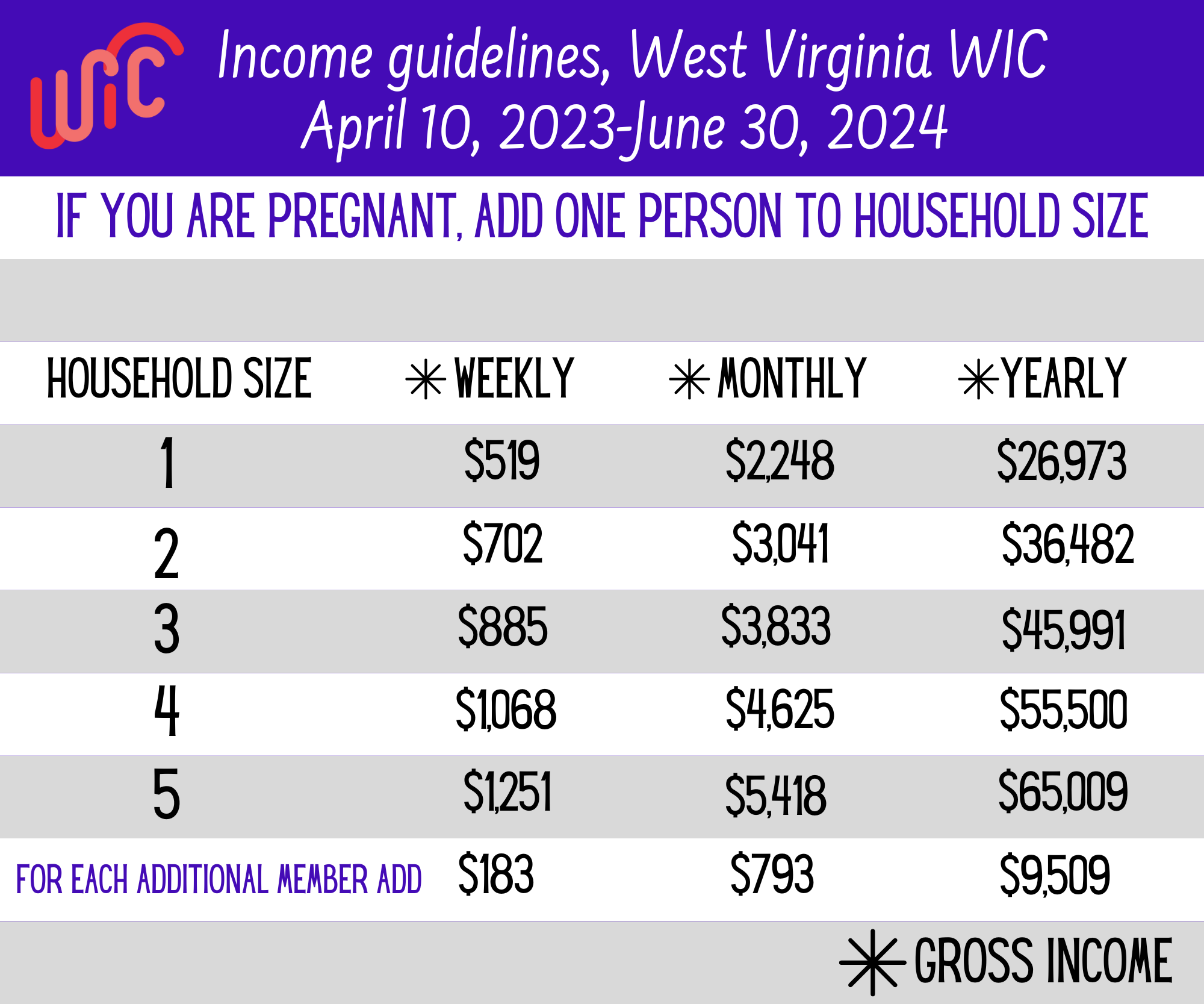

WIC Eligibility Guidelines Monongalia County Health Department, The subsidy calculator below uses the currently available levels to. The income range is $30,000 to $120,000 in 2025 for a family of four.

Calfresh Guidelines 2022, Single yearly income in 2022: Married, joint filing 2025 medicare part b monthly premium 2025 medicare part d monthly premium;

Hsa 2025 Family Limit Ciel Melina, Check your current income limits and va health care. Also called a spenddown program or surplus income program, one’s “excess income” goes towards medical bills, such as medical supplies, prescription drugs, and.

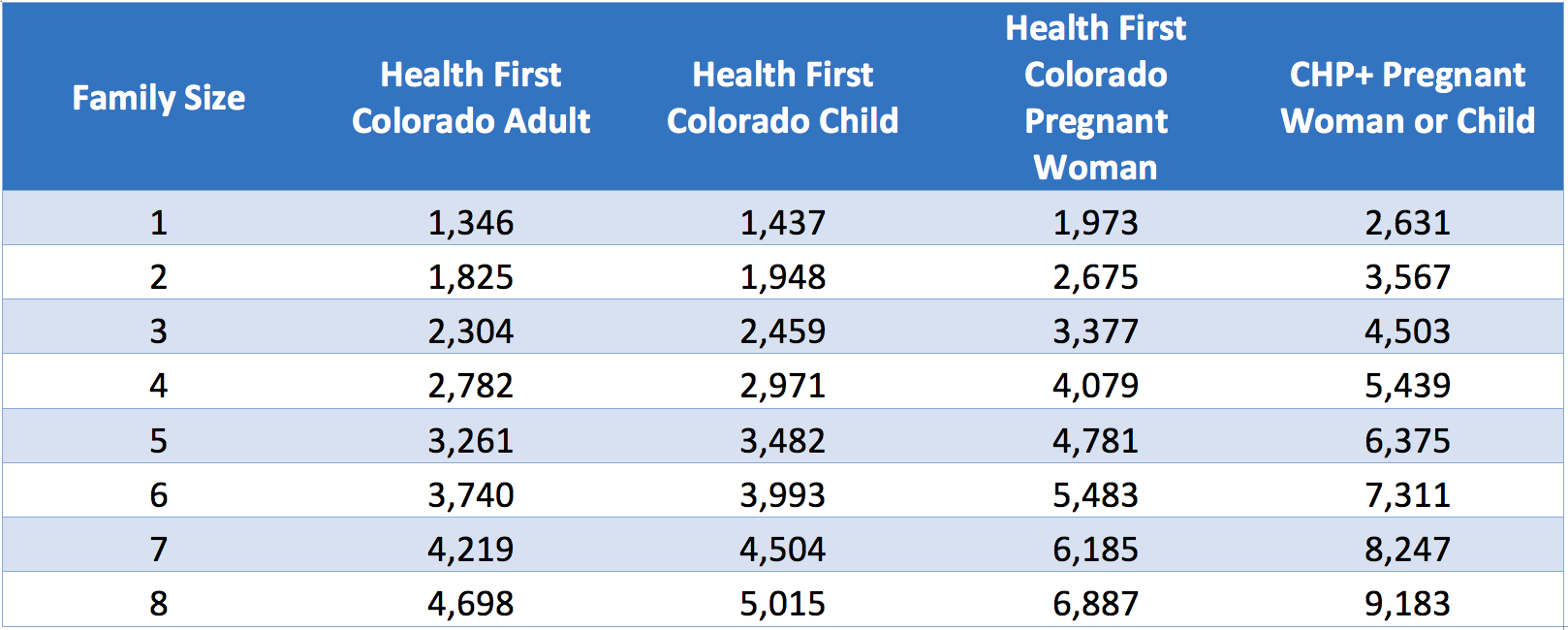

Health Coverage Resources Colorado Consumer Health Initiative, Because of tax deadlines, we usually begin this process in july, the year after you report your income. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part.